A midlife crisis can feel like an emotional whirlwind, but it can also be a quiet financial storm happening underneath. People who spend a lot and are used to a particular way of living may find that the challenges of middle age can greatly endanger their financial security. However, what if we could turn this time of worry into a chance to boost our financial strength? This is where the idea of a "financial safety cushion" comes in—it's a smart method that extends past regular savings and investment techniques.

The Hidden Financial Perils of Midlife

Entering midlife presents a distinct array of financial hurdles that often go unnoticed by wealthy individuals. It's not uncommon for professionals to hit a plateau in their careers or to face sudden job changes. During this time, the demands of supporting elderly parents while also financing their children's college education can put significant pressure on even well-planned budgets. A recent behavioral finance study indicated that middle-aged workers may see their income potential decrease by 20 - 30% during career shifts, yet they continue to have high living expenses.

In addition, as people age, healthcare expenses can turn into an unpredictable financial threat. Costs for top-tier medical treatments, long-term care insurance, and wellness initiatives can quickly use up savings. Together, these issues create a challenging situation, making many individuals in midlife susceptible to unexpected financial difficulties.

Redefining the Financial Safety Cushion

For affluent individuals, having a financial safety net goes beyond merely setting aside money for emergencies. It involves a thoughtful approach that incorporates cash flow, varied investments, and ways to lessen risks. Rather than just depending on standard savings options, look into different investment avenues like private equity, hedge funds, or art.These can safeguard against changes in the market and could result in improved profit margins. It’s also crucial to think about effective tax strategies.Wealthy individuals usually encounter hefty taxes that can diminish their savings over time. By adopting sophisticated tax planning methods, such as creating family limited partnerships or using charitable remainder trusts, one can maintain wealth and maximize the effectiveness of their income.

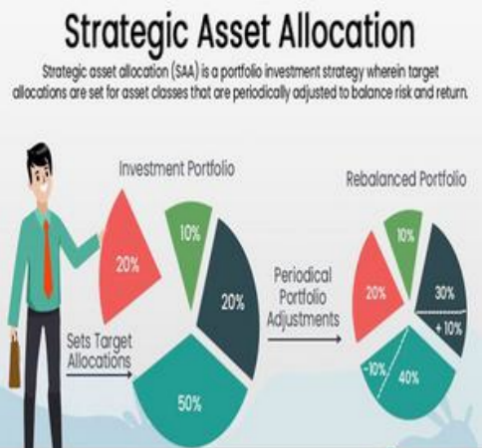

Building Your Fortress: Strategic Asset Allocation

A strong financial safety net depends on how you distribute your assets. Rather than focusing all your resources in one area, spread them out across various asset types, regions, and sectors. Set aside some of your investments for secure, income-producing options like real estate investment trusts (REITs) or high-quality bonds, which can generate consistent cash flow.Additionally, embrace innovation. Consider investing in up-and-coming fields like fintech, biotech, or clean energy, as these areas can offer significant growth opportunities. By blending stability with growth-focused investments, you will build a well-rounded portfolio that can withstand challenges in midlife.

Preparing for the Unpredictable

Midlife brings many changes, making the ability to adjust very important. To ensure your financial security, allocate some liquid assets that are easily accessible for emergencies. It may also be wise to look into umbrella insurance to cover unexpected liabilities, particularly if you own valuable assets.

Additionally, partnering with financial professionals who know the nuances of planning for high-net-worth individuals is essential. A knowledgeable wealth manager, tax consultant, and estate planner can collaborate to devise a tailored strategy that meets your long-term objectives and gives you confidence during this important time.When facing financial challenges in midlife, having a well-planned financial safety net is your key asset. By considering innovative strategies and adopting a comprehensive approach, you can navigate midlife difficulties while coming out stronger, more secure, and ready to confidently step into the next phase of your life.