In a time when economic unpredictability and the appeal of quick rewards are prevalent, many young people are drawn to the idea of "laid-back" or "hands-off" wealth management. High-net-worth individuals watching this trend may wonder: Is it possible for a relaxed style of financial management to deliver lasting success, or does it carry risks that ignore important financial details?

The Allure of Effortless Wealth Management

The popularity of relaxed wealth management for younger investors is clear.In our busy world today, where time is precious, automated investment options, robo-advisors, and simple portfolio management offer great convenience.These resources take care of things like asset allocation, rebalancing, and decision-making through algorithms, enabling investors to direct their attention to other life areas without the need to constantly watch the market.

Moreover, the simplicity of these techniques aligns perfectly with the ongoing minimalist trend. Rather than dealing with complicated financial terms and continuously studying market fluctuations, young investors can choose diversified index funds or ETFs that reflect overall market trends. This method appears to reduce the anxiety linked to active trading, making it appealing for those who are just starting in finance.

The Hidden Risks Beneath the Surface

Although the concept of effortlessly growing wealth is appealing, "lie-flat style" wealth management has its drawbacks. A major issue is its inability to adapt. In a world where economies can change quickly and global events or technological shifts occur, financial markets can be greatly affected. A passive investing strategy might not react fast enough to these shifts, making portfolios at risk. For example, during times of high inflation or sudden market crashes, taking a hands-off approach could lead to significant losses that could have been avoided with prompt action.

Another concern is the idea that investment solutions can be universal for everyone. Robo-advisors and automated services usually depend on uniform risk profiles and investment strategies. Yet, high-net-worth individuals, even those from younger generations, may have distinct financial objectives, complicated tax circumstances, or specific types of assets they want in their portfolios. A passive investment strategy might overlook these personal details, which could restrict their long-term gains.

The Middle Ground: Informed Passivity

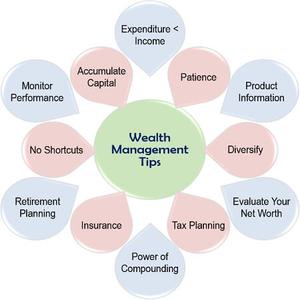

Instead of completely disregarding "laid-back" wealth management, a balanced approach can merge the advantages of a relaxed style with well-informed choices. Young investors who spend generously should begin by learning the basics of finance. Gaining knowledge about important ideas like asset allocation, risk tolerance, and market cycles lays the groundwork for making better decisions when establishing passive investment plans.

Moreover, regular reviews of the investment portfolio are vital. Even with automated tools, it’s important to evaluate how investments are doing, reassess financial objectives, and implement any changes needed to improve the effectiveness of a passive strategy. For instance, as life circumstances evolve—such as job promotions, receiving inheritances, or experiencing significant events—modifying the investment plan to suit new goals is essential.

Leveraging Resources for Success

Young individuals with substantial wealth can utilize various resources to enhance their easygoing approach to managing finances. Working occasionally with professional financial advisors can offer useful insights and tailored guidance. These experts can refine automated investment strategies, align them with long-term financial goals, and provide support during challenging market conditions.Additionally, going beyond basic robo-advisors and utilizing advanced technology can prove advantageous. Tools for deeper financial analysis, market research platforms, and investment communities can deliver extra knowledge and viewpoints, helping young investors make more informed decisions while following a passive investment strategy.

In summary, although the “lie-flat style” of wealth management is convenient and straightforward, its effectiveness relies on proper execution. For young individuals with significant assets, this can be a practical approach when supported by financial knowledge, consistent portfolio evaluations, and strategic use of professional advice. By finding the right balance between passivity and proactive decision-making, young investors can reap the rewards of effortless wealth management and protect their financial future.