For people with high incomes, the classic question of whether to buy or rent a house goes beyond just having a place to live; it's a smart financial choice. More than just looking at what they can afford, detailed data analysis can reveal unseen costs and future advantages, helping savvy investors make smart decisions.

Unveiling the True Cost of Ownership

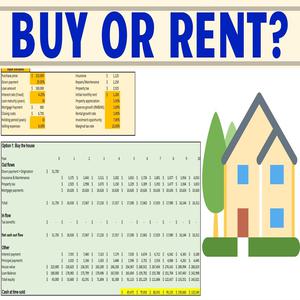

The appeal of owning a home often hides the financial challenges involved. To understand these complexities, it’s essential to consider mortgage interest, property taxes, insurance, and maintenance costs, all of which can greatly increase the initial price. For example, in highly desirable city areas, yearly maintenance can be between 1-3% of the property's worth. By looking at these total expenses alongside rental fees over ten years, we get a better understanding. Sophisticated financial models can include elements such as inflation rates and mortgage repayment plans, and they often show that in certain unstable markets, renting could save more money.

Investment Returns and Opportunity Costs

Often regarded as a stable investment choice, real estate actually shows a lot of variation in its performance. To forecast future profits, one can examine historical data on price increases and rental yields in various neighborhoods. Wealthy investors need to think about opportunity costs too—these are the potential profits lost by investing money in real estate. By looking at the average return on investment (ROI) from real estate and comparing it with other options like stocks, bonds, or private equity, investors can see if owning a home fits their financial aspirations. Sometimes, the advantages of liquidity and diversification that come with other investments may be more beneficial than the long-term profits generated by owning property.

Lifestyle and Flexibility Metrics

For wealthy individuals with busy lifestyles, the ability to move freely is essential. Renting provides the opportunity to change locations without the hassle of having to sell a home, which is especially beneficial for people who change jobs often or work abroad. Information about how long homes typically take to sell and the related costs (generally 6-10% of the home’s price) can illustrate this flexibility. Moreover, personal lifestyle choices can also be viewed in economic terms. For instance, residing in a premium rental in a fashionable area might grant access to special amenities, which could make up for the absence of building equity like one would with owning a home.

Market Volatility and Risk Assessment

The real estate market experiences changes based on the economy, interest rates, and new laws. Investors can understand the risks of owning a home by looking at market volatility indicators and testing financial situations. In areas where prices can drop quickly, renting offers protection during downturns. Risk assessments based on data can also consider local factors like population growth, job stability, and infrastructure improvements to forecast property value trends over time.

Personalized Decision-Making Models

Wealthy individuals can make use of advanced financial planning tools to develop customized decision-making frameworks. These frameworks combine personal financial information, lifestyle choices, and market trends to provide specific advice. For instance, one analysis might indicate that buying a home in a developing suburban location with high rental demand could be a smart investment for building wealth over time, whereas renting in a city center may offer quicker convenience and lifestyle perks.

In summary, deciding whether to buy or rent involves various factors and should be approached with a focus on data. By thoroughly examining financial information, evaluating lifestyle needs, and looking at market risks, affluent individuals can make informed decisions that reflect both their financial objectives and personal ambitions. It’s important to remember that the most suitable option isn’t always the most obvious; rather, it should be backed by solid data and thorough evaluation.