In stock trading, where time is of the essence, Artificial Intelligence (AI) has become a valuable tool. One of its most useful applications is algorithmic trading or algo-trading. This method relies on AI algorithms to buy and sell stocks within a very short time and at a much greater speed. This article aims to understand what algorithmic trading entails, how it operates, and its prospects in the stock market.

What is Algorithmic Trading?

Automated trading refers to the purchase and sale of assets using computer technology that employs explicit set rules for decision-making. These criteria may range from price to volume to time of delivery and even involve complex mathematical algorithms.

By combining data analytics and machine learning technology, AI reaches new heights. AI algorithms process large market data in real-time, recognise potential opportunities for profitable transactions, and execute them in milliseconds at best.

For example, an AI algorithm can discover a pattern that informs it that a certain stock is preparing to increase in price, and it will order a purchase right before other traders become aware of it. This means that once the stock's position has reached its peak, the algorithm will be able to sell the shares it holds and lock profit immediately.

How Does AI in Algorithmic Trading Operate?

Three essential elements are needed for algorithmic trading using AI are:

- Data Collection and Analysis

AI systems constantly collect information from these sources, which include stock prices, business news, and social and economic reports. This information is used by machine learning models to identify trends and predict market trends. - Decision Making

If the presently identified opportunity signifies the optimal point to enter a trade, the AI determines if the trade meets the laid-down criteria. For instance, it may determine that, by looking at the stock's risk level, expected return, and current market situation, it is appropriate to enter the trade. - Execution

One aspect of AI is automated trading, which makes transactions independently without human oversight. Doing this avoids needless waiting and effect, and the trade is completed when it guarantees the highest profit or the lowest loss.

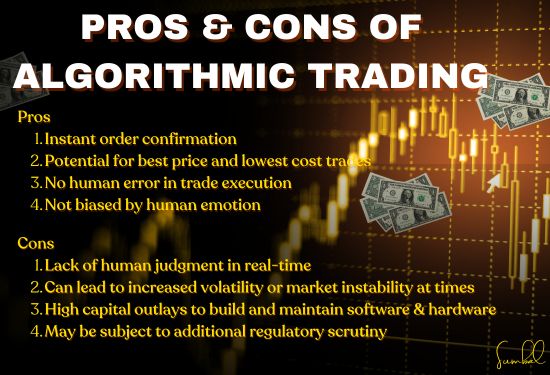

Benefits of Algorithmic Trading

Speed and Efficiency

The ability of AI computer systems to evaluate data and execute transactions in milliseconds gives traders a competitive edge.

Data-Driven Decisions

AI reduces a trader's emotional influence and works based on facts and figures. Improved trading algorithms result in better and more standard trading activities.

Cost Savings

AI also minimises the need for human interference; this removes expenses for the trader and the financial organisation.

Market Liquidity

Algorithmic trading can help bring more effective flows of buy and sell orders to the market, which means more opportunities and ease for others to enter or exit positions.

Risks and Challenges

- Market Volatility

High-frequency trading, as algorithmic trading, increases market fluctuation, especially during unpredicted events. - System Failures

This reliance on technology could mean substantial money could be lost if the system fails or malfunctions. - Lack of Transparency

AI algorithms act like a ‘black box,’ preventing traders and regulators from understanding decision-making patterns. - Unfair Advantage

Small traders or investors who may need more resources to invest in advanced AI technology may be at a disadvantage against institutional investors using the technology.