Many individuals at the top tiers of wealth perceive their financial actions as being based on careful planning rather than feelings. However, hidden beneath the sleek investment strategies and well-planned distributions is a subtle reality: a significant portion of what we identify as “investment” is actually an intricate form of self-soothing, protecting us from the fear of unpredictability and the dread of inaction.

Individuals might fixate on adjusting their investment distributions or pursue trendy assets, presenting these actions as “adaptive optimization” to back up their decisions. However, beneath the surface, these behaviors serve only as a means to alleviate their feelings of uncertainty, a subtle effort to reassure themselves that they maintain control over a reality that is fundamentally unpredictable.

The Illusion of Control in Allocation

Spreading investments across private equity, rare collectibles, and international properties often gives the impression of effective risk management. In truth, this whirlwind of actions frequently stems from a sense of helplessness. Wealthy individuals may complicate their asset portfolios not to enhance profits, but to reassure themselves they can control factors—like market fluctuations and economic changes—that are inherently unmanageable. The process of rebalancing becomes more of a ritualistic activity than an essential task.

Acquiring high-end timepieces, aged wines, or exclusive artworks is commonly labeled as “alternative investment.” More often, these possessions serve as emotional supports. Unlike traditional financial instruments, they provide tangible and aesthetic reassurance. Ownership of a luxurious item fosters a deceptive feeling of stability amidst a tumultuous economic landscape, comforting us that our wealth is tied to something “real,” even if its increase in value is largely uncertain.

Jargon as a Shield Against Doubt

Wealthy individuals and their advisors frequently encase decisions in complex terminology—“alpha creation,” “illiquid options,” “tax-efficient frameworks.” This language does more than indicate expertise; it suppresses feelings of uncertainty. By relying on intricate jargon, investors create distance from the emotional essence of their decisions, persuading themselves that complexity equates to rational thinking, even when the rationale is tenuous.

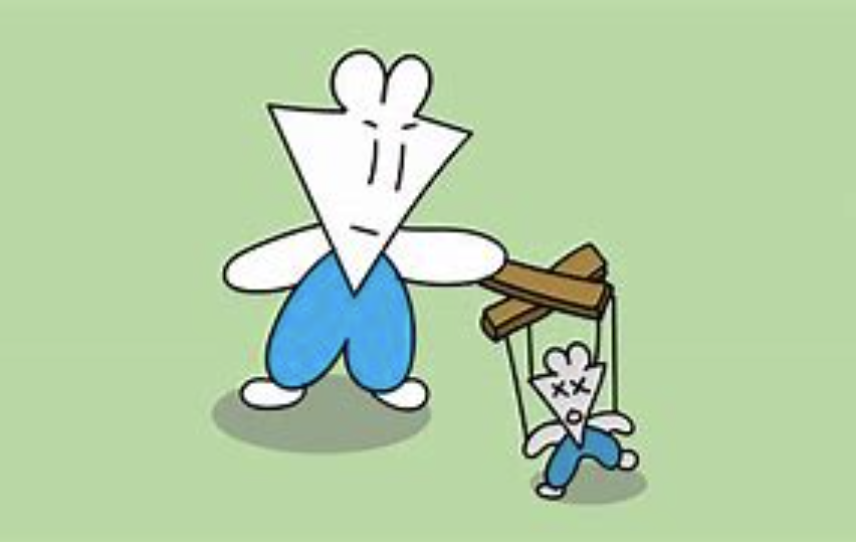

Herd Mentality Disguised as Prudence

Following other affluent investors into niche funds or exclusive opportunities usually does not stem from personal evaluation. It offers comfort in collectivity. When peers with comparable resources make similar choices, it lends validation to the decision, minimizing the anxiety of potential errors. This collective behavior poses as prudence but is fundamentally rooted in the desire to avoid the regret associated with acting independently.

Numerous investors hold on to overly optimistic forecasts for returns, not out of innocence, but as a means of comfort. Expecting a venture to produce exceptional profits helps them to avoid facing the unexciting truth of modest, steady growth—or even losses. These inflated beliefs act as a protective layer, postponing the emotional confrontation with the realities of financial limits.

Reclaiming Rationality from Comfort

Understanding the distinction between investment and self-soothing is not a critique but rather a pathway to understanding. For affluent individuals, the objective should not be to eradicate emotions but to disentangle them from strategic planning. This involves evaluating whether a decision furthers financial objectives or meets emotional requirements, favoring simplicity over intricacy, and acknowledging that uncertainty is a natural part of investing. True investment bravery lies in confronting reality directly instead of merely comforting ourselves.