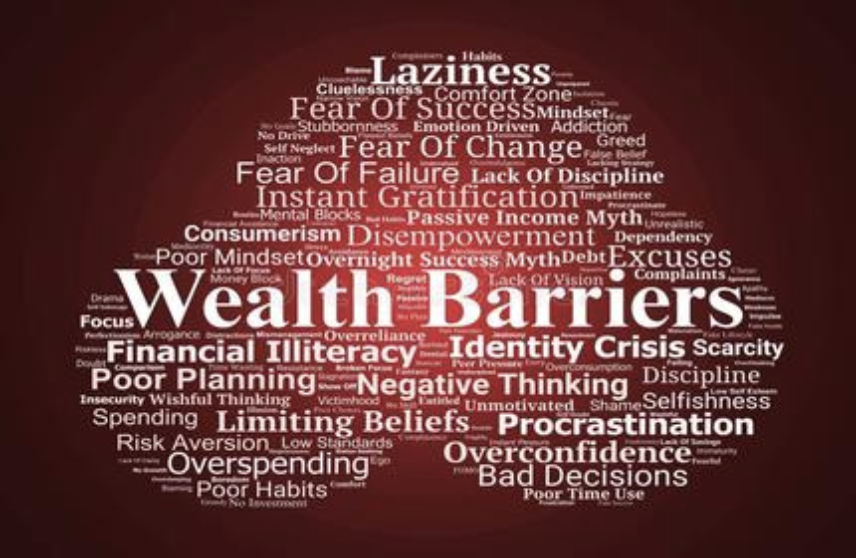

High-net-worth individuals frequently attribute stagnant income to skill gaps or market saturation, neglecting a more essential factor: mental limitations. Your capacity to earn is constrained not by your actual abilities but by your understanding of wealth, value, and prospects. Overcoming income stagnation requires a significant shift in mindset—replacing traditional financial beliefs with a strategic viewpoint that reveals new revenue opportunities, particularly for individuals who approach their mental development with the same audacity as they do their luxury assets.

Wealthy earners often underestimate the non-physical assets they currently possess—such as specialized knowledge, access to exclusive networks, and insights into niche sectors—because of mental biases that equate value solely with tangible labor. Transitioning from the notion of trading time for money to leveraging influence and intellectual resources reimagines earning potential. For example, organizing invitation-only industry discussions or licensing unique methodologies utilizes current strengths without increasing effort—a change that is only possible when thought processes advance beyond conventional work models.

Opportunity Filtering: Cognitive Blind Spots

Your brain's inherent filters, molded by previous successes and cultural standards, obstruct promising opportunities. Affluent groups frequently cling to well-known investment categories, overlooking niche opportunities like luxury experience subscriptions or impact investments that yield high returns. These omissions arise not from a shortage of funds or skills but from mental rigidity that favors comfort over innovation. Shifting the perspective from “unfamiliar” to “untapped” opens pathways to significant wealth increases.

Wealth Stacking vs. Linear Earning

Cognitive barriers keep many individuals stuck in a linear earning approach—exchanging additional hours for minor increases—while top wealth builders embrace a stacking strategy. This involves creating multiple complementary income sources: a luxury brand entrepreneur might develop a private consultancy, licensing arrangements, and an exclusive membership club. Each stream functions independently, enhancing income without a similar increase in effort—this method becomes evident only when thinking moves beyond the “one business, one income” concept.

Affluent individuals often reach a plateau by adhering to familiar strategies, overlooking the fact that market conditions shift more rapidly than their skill sets. Mental complacency—believing that previous achievements assure future outcomes—results in overlooking changes, such as undervaluing digital assets or sustainable luxury trends. Investing in cognitive advancement—through elite mentoring, niche market analysis, or high-level mindset coaching—costs significantly less than the losses incurred from stagnant earnings.

Redefining Risk: Cognitive Courage

To foster income growth, it is necessary to take calculated risks; however, mental biases—fear of loss and a preference for the familiar—can impede even the wealthy. Cognitive courage involves differentiating between reckless risks and strategic investments—such as entering emerging markets or introducing a premium niche product. This transformation is not solely about being more daring but also involves training the mind to assess risk in terms of long-term wealth rather than immediate comfort.

Cognitive Legacy: Scaling Beyond Self

The highest income potential diminishes when thinking evolves to establish systems that endure beyond individual contributions. For wealthy earners, this translates to constructing automated teams, intellectual property collections, or family office frameworks that provide income for future generations. This legacy-oriented thought process shifts the focus from “earning” to “designing wealth,” converting temporary achievements into lasting success—demonstrating that income limitations stem from the mind rather than a lack of skills.