Entrepreneurial setbacks are seldom about mere misfortune; they represent a collection of lessons that were not absorbed. For wealthy individuals entering the business realm, analyzing failures critically transforms missteps into frameworks for future achievements.

Neglecting "Resource Flexibility"

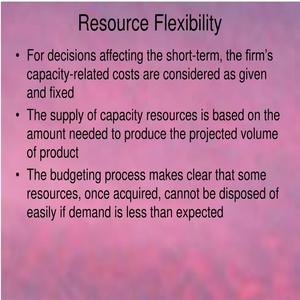

Many entrepreneurs do not fail due to insufficient resources, but rather because of rigid allocation of those resources. Wealthy founders frequently invest heavily in luxurious offices or self-indulgent ventures early in the process, which locks up financial assets that could otherwise support changes in direction. The insight here is to view resources as adaptable instruments rather than symbols of prestige—emphasizing flexibility over appearance to respond effectively to changes in the market.

Mistaking "Connections" for "Loyalty"

Having an extensive network does not guarantee customer allegiance. Entrepreneurs with robust connections often presume that their networks will lead to sales, neglecting the essential effort required to cultivate real trust. Successful evaluations indicate that consumers with significant purchasing power tend to choose brands that address their issues, rather than those they merely recognize.

Overlooking "Decision Overload" Dangers

Independent founders frequently become overwhelmed by minor choices, depleting their energy for significant decisions. Instances of failure reveal that allowing trusted teams to handle low-priority choices (such as office supplies) opens up mental capacity for strategic decisions—like setting prices or forming partnerships—that are crucial for ongoing success. This is particularly important for those accustomed to managing every aspect themselves.

Decision fatigue can impede creativity by causing a slowdown in advancement. When entrepreneurs concentrate on insignificant aspects such as the arrangement of meeting spaces or the design of email formats, they postpone changes in products or the investigation of new markets—chances that frequently establish a startup’s advantage in competition. Creating well-defined structures for decision-making aids in directing attention towards significant actions instead of becoming bogged down in trivialities.

Misinterpreting "Niche Market" Indicators

Pursuing "distinct" concepts without confirming demand is a typical mistake. A high-end pet product company may collapse not because the idea is flawed, but because it serves a market segment that is too limited for sustained growth. An analysis after failure underscores the importance of validating demand with minimal viable products (MVPs) prior to expansion—even for luxury-oriented ideas.

Failing to Recognize "Team Compatibility"

Prioritizing qualifications over shared principles jeopardizes numerous initiatives. Wealthy founders might attract exceptional talent but may face conflicts regarding long-term objectives—such as aggressive scaling versus sustainable growth. Experience indicates that aligning team members around fundamental values (like a focus on customers) fosters greater resilience than just impressive qualifications.

Evading "Self-Reflection"

The most crucial lesson is the need for sincere introspection. Many entrepreneurs attribute their problems to outside influences, overlooking how their own pride or fear of failure may have distorted their decision-making. Effective evaluations involve disentangling emotions from factual circumstances—acknowledging when a theory was incorrect, and using that clarity to improve future approaches.

Failure should not be perceived as an endpoint but rather as a change in direction. For entrepreneurs with significant purchasing power, embracing these insights allows them to convert challenges into opportunities, ensuring that their next ventures are grounded in knowledge rather than solely in aspirations.