In 2025, exciting new technologies are changing the financial landscape, giving wealthy individuals amazing chances to handle their money. These financial tech developments make it easier to manage finances while also offering advanced methods for growing and protecting wealth.

AI - Powered Wealth Management

Artificial Intelligence is revolutionizing wealth management. Through sophisticated algorithms, it can process large quantities of financial information, such as market trends, past performances, and economic signals, all in real time. This advancement means that affluent consumers receive tailored investment recommendations that surpass what conventional financial advisors can offer.

Robo-advisors powered by AI are becoming more advanced. They can design personalized investment portfolios that align with a person's risk appetite, financial objectives, and investment timeline. These automated advisors keep a constant watch on portfolios and make necessary adjustments to maintain peak performance. Instead of a human advisor needing to assess and modify investments every few months or once a year, AI enables automatic updates in response to market changes. This real-time adjustment can lead to potentially higher profits over time.

In addition, AI offers improved predictions of market trends. By examining patterns and relationships that might escape human analysts, it can uncover investment prospects before they gain popularity. Wealthy investors have the chance to take advantage of these opportunities early on, whether in growing industries or undervalued investments.

Blockchain - Enabled Financial Transactions

Blockchain technology has evolved beyond its initial link to cryptocurrencies. By 2025, traditional financial institutions are increasingly adopting it due to its enhanced security, transparency, and efficiency. For affluent consumers, there are several benefits of utilizing blockchain in managing wealth.

A major advantage lies in transactions across borders. Conventional methods of sending money internationally can be costly, sluggish, and often require several intermediaries. Annuities are useful for giving a steady income either for your whole life or for a set amount of time.This change not only significantly lowers transaction fees but also accelerates the overall transfer process. Individuals with substantial wealth who regularly deal in international business or investments can now transfer large amounts of money across borders more swiftly and affordably.Moreover, blockchain significantly boosts the safety of financial transactions. Its decentralized structure means there’s no central point that can fail or be susceptible to hacking. Every transaction is secured through encryption and kept on a shared ledger, which makes it very difficult for wrongdoers to tamper with. This increased safety is vital in wealth management, particularly when handling high-value assets.

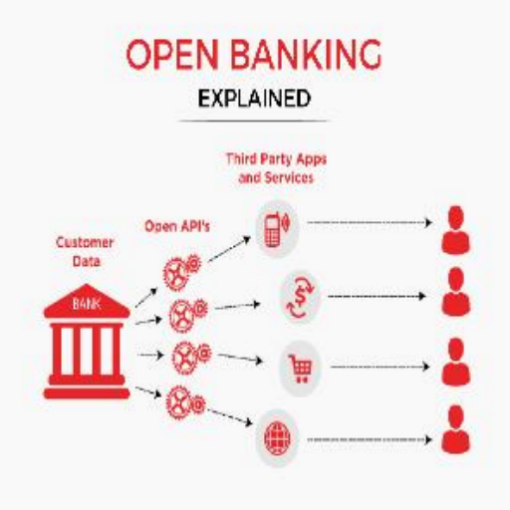

Open Banking and Integrated Financial Services

In 2025, open banking has become increasingly popular and is changing the way wealthy individuals manage their finances. By securely exchanging financial information between banks and institutions, it creates a more unified financial experience.

Affluent consumers can bring together their banking, investment, and credit card accounts into a single dashboard. This total overview makes managing wealth easier, allowing for better decision-making and improved financial planning.Additionally, open banking encourages innovation. Developers from third-party companies use this shared data to provide tailored financial advice, automated savings options, and personalized loans, specifically designed for the needs of wealthy clients.

Overall, fintech developments like open banking, along with tools driven by AI and blockchain technology, are transforming how the wealthy approach wealth management. By adopting these innovations, individuals can achieve greater efficiency, security, and customization, leading to sustainable financial success.