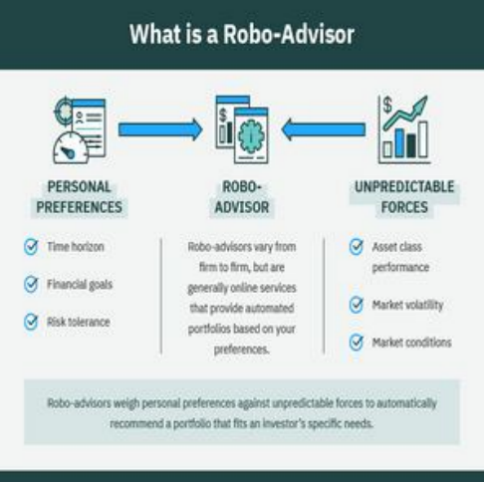

At the age of Fingering, Robo Technology Councils have become a revolutionary force in the landscape, suspended a fort of debate between winter, especially those with great power. Even if you promise accessory solutions and question: are a reliable livestock of investors, or hide traps hide?

The Illusion of Algorithmic Omniscience

Robo's advisors to trust the complex algorithms to handle portfolies, often giving the impression of infallibility. However, these algorithms working in the limits of historic data and default models. During the economist market events, as the economic economic shocks caused by the world's or geopolitic turmines, their predictive abilities to cease. The nature of the "black box" of these algorithm also means that investors often have a limited summary of as their portfolios are Administered. Persons with high spikes used to custom finalized advice can be found in loss, unable to fully accurate the decision processes after they are investments. This lack of transparency can lead to sudden losses, as algorithms cannot consider the unique financial or tolerances of the risk that considered a human counselor.

Dynamic Adaptation Challenges

One of the main argument for sales of Robo Advisors is their ability to automatically prove a portthenos. In theory, this following that investments remain relating to the market conditions and risky profile of an investor. In practice, however, the screw and stiffness of the algorithm's rehab can be a two -wire sword. In the unstable markets, quick adjustments can cause innecessary costs of negotiations, eating reactions. In addition, these automated systems find it difficult to fit the sudden changes Macroeconomic manufacturers requiring human judgment. For example, a robo counseling can not predicts to the cartoon to the book of a new specific industry, bring to portaculal carrying the best of the long investor.

Behavioral Biases in Disguise

Despite the conviction that Robo's advisers remove emotional decision, they cannot reinforce a certain prejudices of behavior. Many Robo Advisors to assess tolerance to the risk of an investor, but these simple simple can not specify with complex financial behavior. Eg, a high net worth investor may have a single risky appetite based on their long-term financial goals and their experienced investment, which are standardized The questionnaire cannot fully explain. Instead, the nature comfortable and unsuccessful of robo recommendations can sleep a fake sense of safety, which make them pays of automated systems and to their investments. This gap can lead to opportunity or not face the risks in a timely development.

The Human Touch Factor

Despite the conviction that Robo's advisers remove emotional decision, they cannot reinforce a certain prejudices of behavior. Many Robo Advisors to assess tolerance to the risk of an investor, but these simple simple can not specify with complex financial behavior. Eg, a high net worth investor may have a single risky appetite based on their long-term financial goals and their experienced investment, which are standardized The questionnaire cannot fully explain. Instead, the nature comfortable and unsuccessful of robo recommendations can sleep a fake sense of safety, which make them pays of automated systems and to their investments. This gap can lead to opportunity or not face the risks in a timely development.

Navigating the Robo-Advisor Landscape

For high investors, robo recommendations can be a valuable tool when strategically occurred. Fighting the efficiency of robe advisors with periodic consultations with human financial experts can move their bounds. Compelling the strengths and weaknesses of these automated systems may benefit of Robo's advisors for the basic portfolio of the partner's financial planning. Run in -Depth Care Reasonable to Foundation Algorites, data resources and regulating robo recommendations are also unsigned to guarantee safe investment experience.

in conclusion, rodic recommendations are not a controlled bike no inevitable trap. They present both opportunities and challenges for investors. Approaching an examiner eye and a balanced strategy, individuals and expenditure may exploit the advantages of Ropo advice as he protects their restricts in a Investment landscape.