For individuals with high incomes, the FIRE (Financial Independence, Retire Early) movement transcends mere trendiness; it embodies the pursuit of exchanging lengthy careers for freedom in life. However, in contrast to the stereotype of "extreme frugality," wealthy participants in FIRE encounter distinct opportunities and challenges. The relevant inquiry is not about whether early retirement is feasible, but rather how to create a retirement that aligns with personal lifestyle choices, rather than solely focusing on financial standing.

FIRE for Wealthy Individuals: Not About Cutting Back

Conventional FIRE emphasizes minimizing expenditures, but those with high spending habits require a FIRE strategy that resonates with their affinity for luxury. It doesn’t mean forgoing travel or gourmet dining; it involves reallocating 40–50% of earnings to high-performing investments while maintaining essential lifestyle expenses. An individual earning $300,000 who allocates $150,000 to significant experiences and invests the remainder can achieve FIRE more swiftly than someone who sacrifices enjoyment for the sake of speed.

The “Sustainability figure” for Lifestyle

Disregard the standard rule of needing 25 times your expenses. Those with wealth should determine a sustainability figure for their lifestyle, factoring in anticipated future expenses such as private healthcare, extravagant travel, and plans for legacy. If your preferred annual lifestyle is $200,000, your FIRE target isn’t merely $5 million; it should be adjusted to around $6–7 million to account for inflation and unforeseen costs. This pragmatic figure helps to avoid a decline in lifestyle after retirement.

Active-Seeming Passive Income

Wealthy individuals pursuing FIRE do not solely depend on index funds. They intentionally establish passive income sources: a boutique hotel allowing free travel, a wine collection that produces financial returns along with enjoyment, or shares in a tech startup offering payouts resembling dividends. These investments ensure a steady cash flow while resonating with personal interests, allowing retirement to feel rewarding rather than inactive.

A significant number of affluent adherents of FIRE opt for career transitions rather than fully retiring. Instead of stopping work altogether, they shift to projects that ignite passion—offering consulting in their area of expertise, starting a nonprofit, or assembling an art collection. This form of “semi-retirement” maintains cognitive engagement while allowing financial assets to cover the majority of living costs. It redefines retirement: engaging in work because of desire rather than necessity.

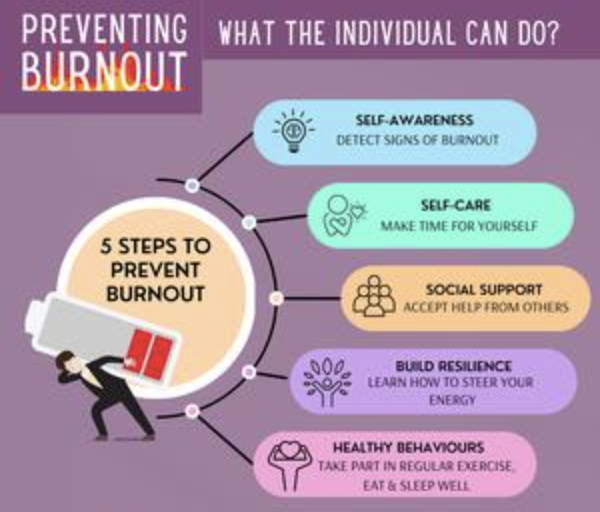

Preventing “FIRE Burnout”

Pursuing FIRE can sometimes cause exhaustion, particularly for high-achieving individuals accustomed to success. They experience FIRE burnout when the quest for a specific number overshadows current satisfaction. Savvy planners incorporate “mini-rewards” throughout their journey: enjoying quarterly luxury retreats, investing in hobbies, or taking sabbaticals. These intermissions help prevent feelings of resentment and sustain motivation towards the ultimate goal without draining enthusiasm.

Incorporating Legacy into FIRE Strategy

Wealth-oriented FIRE is not solely focused on individual freedom but also on legacy. Incorporating philanthropic efforts, family trust arrangements, or mentorship initiatives into your plan provides depth to retirement beyond just relaxation. A FIRE portfolio valued at $10 million that supports a scholarship or helps maintain a cultural site transforms early retirement into an opportunity to make an impact, enhancing the significance of the journey.

For those who earn a lot, achieving FIRE is unquestionably attainable—but it demands moving away from generic standards. It is about striking a balance between aspiration and enjoyment, progress and purpose, while constructing a retirement that is rich in both valuable experiences and financial prosperity.