In the field of richness of wealth, the gloss between rich and difficult not only a matter of income - it is a profound deep in the opposite mental. For the high-significant food intended for prisor and develop its wealth, it is important to understand these cognitive changes. Here is an exploration of the deposit amount of deposit that they really separate the financial intelligence to have the least rich.

The Perception of Risk and Failure

One of the most important differences lies in risk mode and failure are perceived. Average mentality often assemble the risk of a neighboring disaster, driving to care and a "safe" preference but to a short time considered to warming accounts. This disgust continues for the fear of the small loss they have, creating a limiting library lines of financial ponds.

in contrast, risk of rich appearance as essential essential component. They do not exit calculated risks, you understand that opportunity with a high reward are often carrying with an element of uncertainty. Get, for example, prospects prosperous that investing apparous writing patterns or development markets. On the failure face, they don't see it because a dead final but as a valuable learning experience. A teching tylicology can analyze the initial company to identify bigger success.

Time as a Strategic Asset

Another inequality in the mentality appears in the evaluation of time. Those who have a bad mood often exchange their time for money in a linear way, believing that the work time is the only way to a financial gain. They can take some low work or stand in positions that are not satisfactory by the fear of the unsteady, sacrifice the powerful increased income.

On the other hand, the rich realizes that time is a finished and valuable source. If you focus on activities that generate Exponential reactions to their timely investments, such as strategic planning, network building or developing high value skills. For example, a rich investor takes time to grow relations with the experts of industry that can open the doors by opportunities enjoy investments. Even routine tasks to leave the most influential job, admitting that the benefit of the efforts is the wich rate key.

The Role of Education and Adaptability

The poor mindset often assume that official education is the end of the learning. Once they have graduated, we are looking for nine-lose trends and opportunities of evolving in financial landscape. This stiffness makes it difficult to suit the economic changes or technological concerns. However,wealthy mentality adopt the life of life as a cornerstone of financial success. Are usually strengthen in new investment strategies, in development of markets and Innovative financial means. For example, rich people can participate in e-griefing alternary seminary as protected funds or protected funds, allowing their burders before the curb. Its desire to fit them allows you to roll in response to market changes, maintain a competitive advantage in the creation of wealth.

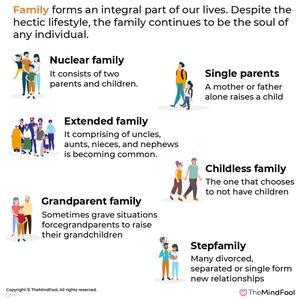

Social and Family Financial Dynamics

The funding mode discussed and managed in social circuits and family even vary significantly. In families with the poor mentality, money is often a taboo subject, driving to the lack of writing and common planning. Family members can make impulsive financial decisions, regardless of a collective impact, result in debt chicken or lost opportunity.4C24 and Cichiglie families, for another Bola, Prioritije Financial Education is open communication. Them. Include young generations in financial discussions, teacher investments, budget conservation and wealth by an early age. Coming a Culfel of Financial Aware, Guarantees that the wealth of the family is maintained between the generations. For example, a rich family can create a family office to benefit investments, the prompts a sense of shared fingerprints and the strategy decision.

in conclusion, divergence between rich And mediocre mentality in financial intelligence extend beyond the surface changes. Atopture and Perspections Riccies Reciple - the risk of a kisses of kissing, the advantage of education - your financial attention promotion - Scarced Newaters.