In a time of fast consumption growth, those with significant financial resources frequently lead trends by choosing luxury products, high-end services, and unique experiences. Yet, hidden within this attractive way of life is a real risk known as “invisible poverty.” As the distinction between indulgence and smart spending becomes less clear, many affluent earners might unintentionally experience “reverse-harvesting,” where their buying choices negatively impact their future financial stability.

The Illusion of Status - Symbol Consumption

Luxury brands and high-end products have always been linked to social standing. In this era of increasing consumerism, the urge to showcase wealth has grown stronger. People who spend a lot might buy items more for their social value than their usefulness. Examples include limited-edition bags, expensive watches, or exclusive club memberships, which are often viewed as markers of achievement.

Nevertheless, indulging in these status symbols can have its downsides. Luxury goods usually lose value quickly, and the endless chase for the newest trends can exhaust financial savings. Furthermore, striving to uphold this image can lead to overspending, trapping individuals in a cycle of debt while they try to maintain a facade of prosperity.

The Trap of Experience - Oriented Debt

The increase in luxury experiences, along with the consumption of material goods, has played a significant role in creating "invisible poverty." Wealthy people often indulge in extraordinary experiences like traveling on private jets, enjoying luxury cruises, or staying at exclusive resorts. Although these experiences can be fulfilling, they tend to carry a substantial cost.Sometimes, people resort to using credit or loans to fund these activities, thinking their high salaries will make repayment straightforward. Unfortunately, unforeseen financial difficulties, like losing a job or an economic slump, can quickly transform these once-in-a-lifetime trips into financial strains. The enticing nature of these experiences, paired with easy credit access, can ensnare even those who are best at managing their finances in a difficult economic situation.

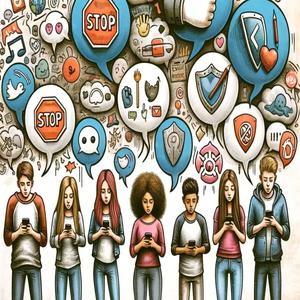

The Role of Social Media and Peer Pressure

Social media significantly influences the trend of upgrading consumption, which in turn increases the risk of "invisible poverty." Platforms such as Instagram and TikTok are filled with visuals of lavish lifestyles, fostering a culture where comparison and fear of missing out (FOMO) thrive. Those who spend a lot might feel compelled to match their friends, regularly enhancing their belongings and experiences to uphold their social image.

This consumption driven by peers is often worsened by social media’s selective representation, where only the best moments of people’s lives are displayed. Consequently, individuals may stretch their finances too thin in an attempt to project an image of success and wealth, often oblivious to the gradual decline of their financial health.

Strategies for Avoiding Reverse - Harvesting

To avoid falling into the trap of "hidden poverty" amid rising consumption, individuals who spend excessively must approach their spending with greater awareness. First and foremost, it’s essential to differentiate between what you want and what you truly need. Before buying something, reflect on whether it genuinely enhances your life or if it's merely a reaction to societal pressures.

Next, establish a detailed financial strategy that aligns with your future aspirations. This strategy should encompass a well-defined budget, savings goals, and investment plans. By having a robust financial guideline, you can make better choices regarding your spending, ensuring that your consumption habits enhance rather than undermine your financial health.

Lastly, be wary of the effects of social media and peer influence. Keep in mind that online portrayals are often misleading, and genuine wealth isn’t defined by the brands you possess or the adventures you share. Concentrate on creating a satisfying, sustainable lifestyle that fits within your budget.

In summary, while upgrading your consumption may seem appealing and indicative of a lavish lifestyle, it also presents the danger of "hidden poverty" and counterproductive habits. By recognizing the factors behind this issue and applying effective financial methods, those who spend significantly can enjoy a high-quality life without compromising their long-term financial stability.