As technology advances quickly, artificial intelligence (AI) is becoming a major force that transforms investing far beyond the old methods of analysis. For wealthy individuals who want to improve their investment portfolios and manage challenging financial markets, grasping the impact of AI is essential, not merely a passing trend.

Unveiling Hidden Patterns with Machine Learning

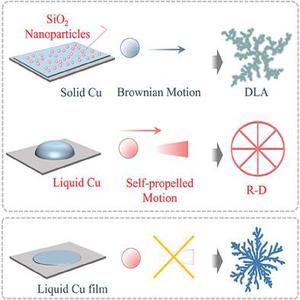

Traditional methods of investment analysis usually depend on past data and human judgment. In contrast, machine learning algorithms powered by AI can handle enormous quantities of information at speeds that far exceed human limits. These algorithms examine not just financial reports and market trends, but also various alternative data sources such as satellite images of parking lots, sentiments expressed on social media, and even weather changes. For instance, assessing satellite pictures to monitor foot traffic at retail locations can offer early insights into how well retail stocks might perform, allowing investors to forecast market shifts before conventional indicators catch up. This capability to reveal hidden trends empowers sophisticated investors to spot new opportunities and potential risks that might otherwise go unnoticed.

Dynamic Portfolio Optimization

AI allows for immediate portfolio adjustments, reacting quickly to shifts in the market. Rather than depending on scheduled evaluations, advanced AI systems constantly assess and modify portfolios by taking many elements into account. They analyze the relationships between various asset types, economic signals, and global political issues. For example, when political unrest increases, an AI-powered platform can swiftly realign a portfolio, lowering investment in at-risk assets and boosting investment in safer options such as gold or government securities. This flexible method guarantees that portfolios are fine-tuned for optimal returns while reducing risks, which is essential for wealthy investors who have large sums of money involved.

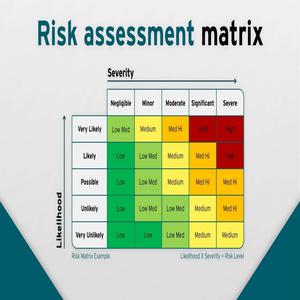

Risk Assessment Reinvented

Artificial Intelligence is transforming how we evaluate risks by integrating a broader set of factors and applying sophisticated modeling methods. Unlike conventional risk assessments that depend on basic assumptions, AI takes into account intricate relationships and rare but significant risks. For instance, AI models are capable of conducting simulations of numerous scenarios to evaluate the possible effects of an unexpected major event on an investment portfolio. By examining both past and current data from various sources, these models can deliver improved estimates of risk probabilities, enabling investors to better understand their risk tolerance and strategize on mitigating possible losses.

The Human-AI Partnership

Even with the advanced abilities of AI, the personal touch of humans is still vital in making investment choices. Wealthy investors offer distinct knowledge, experience, and an understanding of qualitative elements that AI might miss, including specialized industry insights or evaluations of management quality. The best investment approaches frequently combine human intuition with the insights generated by AI. Investors rely on AI as a strong resource for data-based suggestions, but they ultimately make the final choices, considering aspects that extend beyond mere statistics.

Ethical and Regulatory Considerations

As artificial intelligence becomes more integrated into investment activities, it brings forward significant questions regarding ethics and regulations. Concerns like biases in algorithms, the opaqueness of AI’s decision-making processes, and the risk of market manipulation must be approached with caution. Investors with substantial wealth need to recognize these issues and make sure that the AI technologies they employ are crafted and overseen in ways that uphold fairness and responsibility.

To sum up, AI is more than a mere tool; it is a powerful change agent in investment. For affluent individuals, adopting AI alongside a people-focused strategy can unlock fresh opportunities for growth, managing risks, and optimizing portfolios. By grasping and utilizing the strengths of AI, investors can remain competitive in a financial landscape that is becoming more challenging and complex.