Exchange-Traded Funds (ETFs) have become a notable trend in finance, drawing interest from savvy investors, particularly those with substantial funds. more than just a typical investment option, ETFs provide a distinctive combination of attributes that make them an appealing selection in advanced investment portfolios. Let's explore what makes ETFs attractive and why they have become essential for smart investors.

The Tax - Efficient Edge

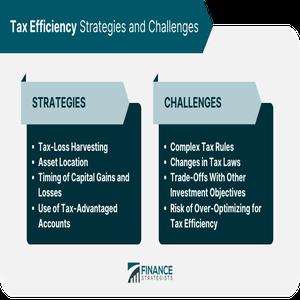

A notable benefit of ETFs that is not widely recognized is their tax efficiency, which is essential for wealthy individuals looking to enhance their after-tax returns. In contrast to mutual funds, which frequently pass on capital gains to their investors, resulting in tax obligations, most ETFs aim to limit these distributions. This happens because of their special method of creation and redemption. When investors trade ETF shares in the open market, it doesn't affect the portfolio directly, lowering the chances of unwanted asset sales that could create taxable events.

For individuals with high incomes, this may result in considerable savings as time goes on.Furthermore, certain ETFs are created with particular strategies to maximize tax benefits, such as those that invest in municipal bonds providing tax-exempt income. By adding these tax-efficient ETFs to their investment mix, individuals can retain a larger portion of their profits.

Diversification Redefined

ETFs offer a unique way to diversify investments like never before. In the past, diversification often involved spreading your funds over several stocks and bonds. Now, with ETFs, an investor can access whole markets, sectors, or themes with just one transaction. For instance, if someone wants to focus on sustainable energy, they can put their money in an ETF that includes a range of renewable energy companies worldwide, thus instantly tapping into multiple firms without extensive research or selecting individual stocks.

Additionally, ETFs can also hold alternative assets such as commodities, real estate, or even securities linked to cryptocurrencies. This versatility enables wealthy investors to create portfolios tailored to their risk tolerance and investment objectives, whether they prefer gold-backed ETFs to shield against inflation or want to take advantage of new trends in fintech.

Liquidity and Cost - Effectiveness

In the realm of high-value investing, having liquid assets is essential, and ETFs excel in providing this. By trading on major stock exchanges all day, ETFs give investors immediate access to a diverse array of assets. As a result, investors can swiftly modify their portfolios to respond to market fluctuations, which is a vital benefit during unstable market conditions.Another significant advantage is their cost-effectiveness. With lower expense ratios compared to actively managed funds, ETFs minimize the impact on returns. For rich people managing large investments, small changes in fees can result in big savings as time goes by.These savings, paired with their high liquidity, make ETFs appealing for both quick trades and long-term wealth building.

Strategic Portfolio Customization

ETFs give investors the ability to build highly tailored portfolios that reflect their individual financial needs. Wealthy individuals can utilize ETFs as fundamental components, mixing various funds to create precise asset distributions. For example, they might pair broad-market ETFs, which offer stability, with sector-focused ETFs that present growth possibilities.

Furthermore, some investors employ ETFs for tactical asset allocation, shifting their investments across different market areas based on the current economic conditions. This degree of customization provides investors with exact control over their risk and returns, allowing them to adjust their portfolios in line with changing financial objectives.

In the realm of investments, ETFs are recognized as a flexible and effective resource for affluent investors. Their benefits, including tax efficiency, diversification, liquidity, affordability, and customization options, make them a top pick for those aiming to enhance their portfolios and secure long-term financial success. With ongoing changes in the financial landscape, ETFs are likely to stay an important part of smart investment approaches.