For people with a significant expense power, credit cards are not only the payment media - they are wearing in a world with improved improvements and financial strategies. Beyond the current tactics, there are sophisticated instruments to maximize credit card points and their integration in an asset management plan.

Decoding Premium Credit Card Ecosystems

High credit cards are often subject to exclusive features appropriate for rich consumers. Instead of aging the a thousand base to basic money or end programs, immersed in warm reward programs. Some reservation premium cards can reservation in guarantees in the restaurants sold - out Michelin - game restaurants or access private art Expositions. By taking advantage of these services for purchases, card holders can benefit of experience that money cannot easily buy.

more, some loans The cards are associated with the luxury marks and the hotel channels. Use the Co -Brand Card partners - to earn extra points in high purchase. For example, purchases the stylish clothes, luxury or reservation is in five - star stations in these affiliations can give a multiplicative effect on the accumulation of points. Arrica not only shopping experience and travel, but fast quickly a point of precious points.

Advanced Point Arbitrage Strategies

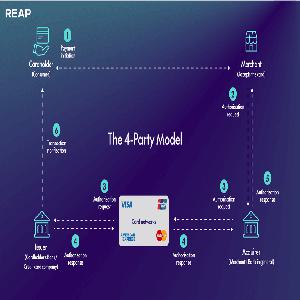

Think beyond simple reimbursements. Advanced holders can be included in the arbitrary of points, a strategy that includes strategic transfer of points between different loyalty programs. Some credit card problems allow transparent transfer of points to the partner, hotel or even acquiring platforms. From exchange rates and seasonal promotions between these partners, the card holders can choose the value of their points.

for example, during peata seasons, some airlines offer Bonus transfer rate. The credit card transfer indicates frequent program of a airline or first class or first class - can offer much more value than direct purchase for paper. Another approach is the Transfer to Hotel Loyalty Programs during the Special Promotions, all paper falls to move onto sunshine or extend its attitude.

Integrating Credit Card Rewards into Wealth Management

Altisime people can integrate credit card rewards in their prettier Instead of using points for personal consumption, consider turning into wealth. Some credit card programs allow points for investment products, as ordinary fundraising actions or gift cards for brokerage services.For more, consider credit card reward as a form of additional income. For example, if the points can be exchanged for region, These can be sold to a reduced fee on the legitimate platforms of the secondary market. The product may then reinvested in more proficient financial instruments, processing credit card prices in a capital source for investment.

Credit Card - Driven Lifestyle Optimization

Use strategic credit cards to optimize your lifestyle and financial. Many premium cards offer advantages as access to airport dorms, previous dorms and free controlled pockets. Correctly take travel purchases in these advantages, High -Cost Travelers can improve their trip to the reduction of costs associated with travel disadvantages.in the field of daily expenses, select cards matching your consumer models. For example, if often comes to the upper end Restaurants, choose a card that offers a tall rewards for restaurants and entertainment. In this way, every catches becomes an opportunity opportunity to achieve points, which can be then purchased for even more luxury experience.

in conclusion, for those with higher expenditure power, credit cards have an unexpicious opportunities to maximize and improve financially. Exploring these advanced technicians, rich customers, can be processing their credit Using cards from a routine expense in a powerful means of accumulating wealth and growth of life.