The global copper market is currently experiencing a thrilling "inventory migration," akin to migratory birds embarking on a large-scale journey to escape the harsh winter.

The news that the United States might impose a 25% tariff on imported copper is like a stone dropped into a calm lake, sending ripples far and wide. Traders, sensing the impending storm, have launched an unprecedented inventory shift. Copper inventories at LIVE warehouses have been steadily declining, while COMEX inventories have surged from about 20,000 tons in August 2024 to over 100,000 tons. This seesawing trend is drawing widespread attention.

The global copper market is witnessing an epic "copper flow migration"! According to monitoring by industry giant Mercuria, a "legion" of 500,000 tons of copper is marching toward the U.S. coast— a volume equivalent to seven months' worth of U.S. consumption. Leading the charge, Mercuria itself has escorted nearly 90,000 tons of this "copper vanguard." Behind this massive migration is a "risk-avoidance operation" where traders are racing against time. Like fishermen rushing back to port at the first sign of an approaching storm, they are scrambling to transfer copper inventories to

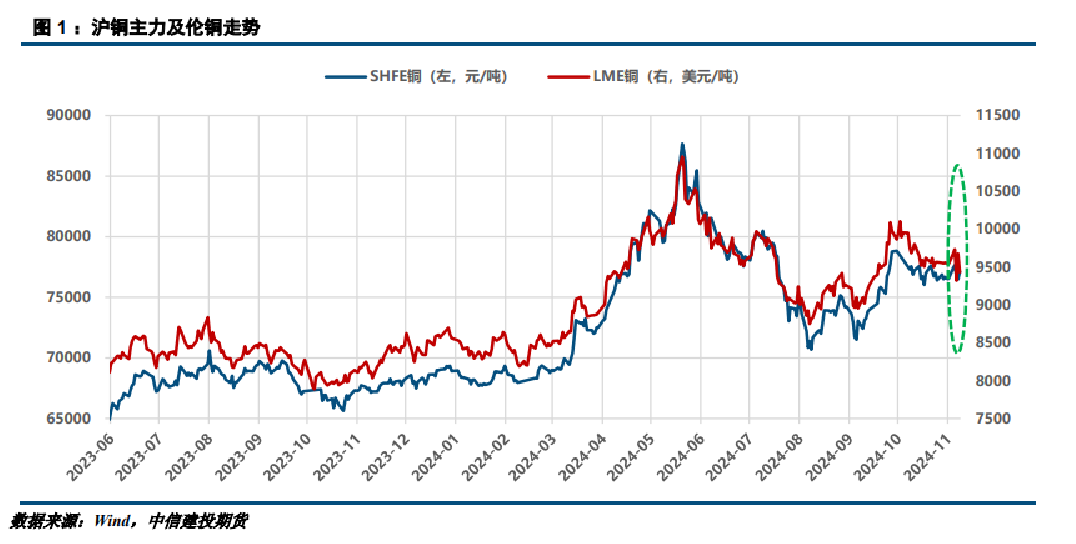

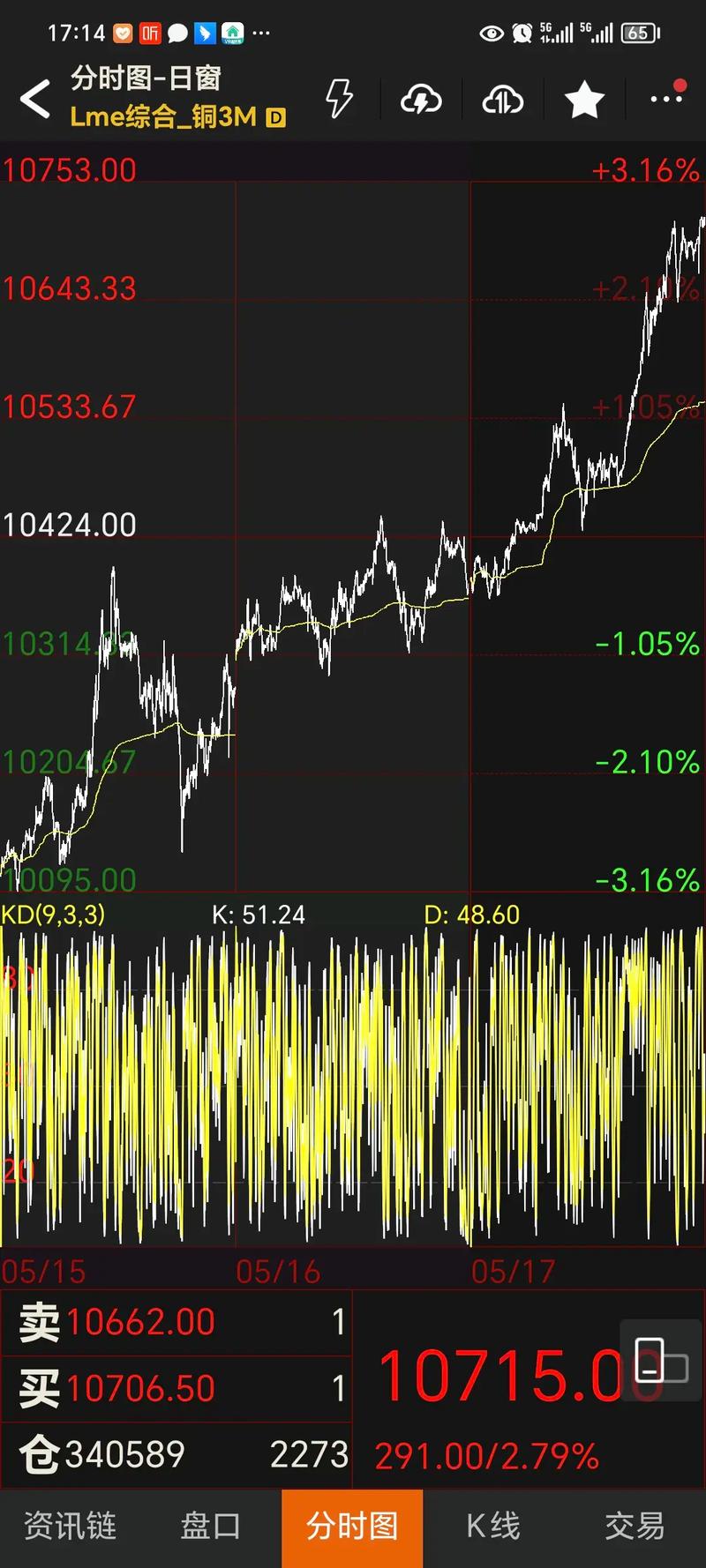

"safe harbours" before the tariff hurricane hits. The ripple effects of this manoeuvre are taken to the waves created by a stone thrown into the heart of a lake: the anticipation of tariffs has triggered the "first domino," causing U.S. copper prices to soar and creating a "profit canyon" of premium space. This canyon, like a magnet, is drawing global copper resources to reroute, further driving up copper prices in other markets and widening the U.S. copper premium- a self-reinforcing "copper price vortex" has thus formed. At this moment, the COMEX and LME markets resemble two interconnected

"water level gauges": as the "siphon tube" of the U.S. copper premium thickens, the price differential between the two has shattered historical records. This erupting price gap, like sweet honey, is attracting arbitrage traders who are transforming into

"copper market movers," accelerating this transoceanic metal transfer. In this wave of policy limbo, the frenzy seems set to continue.

The recycled copper market, however, is trapped in a dilemma of "fire and ice." Since the beginning of 2025, importing recycled copper raw materials has felt like stepping into a quicksand pit, where every transaction is devouring traders' profit margins.

Purchasing willingness has plummeted like autumn leaves falling one by one. If this trend continues, it could tighten the "faucet" of recycled copper supply, leaving downstream processing enterprises facing the risk of a "supply drought." Right now, copper prices are being lifted by the "invisible hand" of supply constraints, while the

The "baton" of macroeconomic factors has temporarily retreated backstage. But this delicate balance could be broken at any moment. Imagine when the supply-side optimism is fully "digested" by the market, and the U.S. economy, the "lead sheep," begins to show signs of fatigue. Market sentiment could make a 180-degree turn. At that point, the looming shadow of recession expectations would hover over the market, and macroeconomic factors would seize the "steering wheel" of pricing again. Becoming the key determinant of copper price trends. This game feels like walking a tightrope-on one side is the reality of supply tightness, and on the other is the looming threat of economic slowdown. Market participants need to be like seasoned surfers, not only riding the current waves but also staying prepared to adapt to sudden shifts in ocean currents.

This copper market " survival game" is dazzling to behold. Investors are advised to approach it like playing musical chairs keep moving while the music plays, but always be ready to grab a seat when it stops. After all, once all the copper base made its way to the United States, this farce would come to an end. At that point, it's all about who reacts the fastest and finds a seat before the music stops!