The "Safe" Nest Egg’s New Volatility

High-net-worth individuals frequently disregard how reforms alter pension fund distribution. Current strategies often decrease the share of low-risk bonds in favor of alternative assets, making even "secured" amounts susceptible to market fluctuations. As a result, your retirement fund may vary based on private equity or real estate market movements—necessitating proactive changes to your portfolio.

Tax Efficiency: Missed Benefits and Fresh Possibilities

Reforms seldom completely eliminate tax advantages; they merely reorganize them. High-income earners may forfeit deductions on voluntary contributions but may gain credits for contributing to a spouse or dependent’s pensions. These alterations necessitate a revision of yearly tax strategies to ensure savings are maximized.

For wealthy individuals, adapting to these changes involves replacing outdated practices with focused strategies. For instance, reallocating funds previously designated for deductible voluntary contributions to a spouse’s pension can facilitate credits that mitigate lost deductions—potentially enhancing family financial stability. Strategic planning is essential here: integrating these new credits with current approaches like charitable donations or asset depreciation guarantees that tax efficiency remains intact during reforms, transforming regulatory changes into opportunities for wealth preservation.

Early Withdrawal Regulations: Flexibility vs. Penalty

The era of uniform withdrawal penalties has ended. The updated regulations permit high earners to access portions of their funds early for activities deemed as "qualifying wealth preservation"—such as establishing a trust or covering long-term care insurance costs—without incurring significant penalties. However, errors in this area may lead to unexpected tax liabilities.

This newfound flexibility presents a dichotomy for affluent individuals, who must consider immediate needs against long-term tax consequences. For example, using early withdrawals to finance a trust can protect assets for beneficiaries, but it requires documentation that confirms the intent for "wealth preservation" to steer clear of penalties. Likewise, using this method to pay for long-term care insurance requires a careful assessment of taxable versus non-taxable components. Collaborating with tax experts to align withdrawals with qualifying purposes transforms this flexibility into a strategic advantage, minimizing the risk of unintended tax implications.

Private Pensions: From Optional to Essential

With public pension limits becoming stricter for high earners, private pension plans are becoming indispensable. Unlike conventional 401(k)s, customized private pensions accommodate alternative investments, allowing retirement savings to sync with your current asset mix for enhanced growth opportunities.

Inflation’s Hidden Pension Decline: Combated Through Reform

Traditional pensions tend to overlook the effects of inflation on high living standards. New adjustments, linked to reform, connect payouts to a "luxury inflation index" that reflects expenses like travel and healthcare instead of just the basic Consumer Price Index. This linkage ensures that your purchasing ability in retirement remains stable over time.

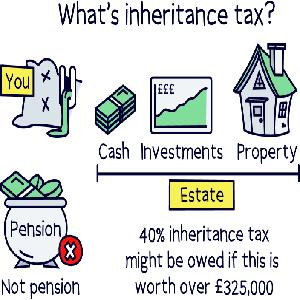

Inheritance Adjustments: Transferring Pensions as Assets

Reforms alter the landscape of pension inheritance. Wealthy individuals can now arrange pensions to function as transferable assets, circumventing probate and enabling funds to be passed to heirs with minimal taxation. This approach transforms a retirement instrument into a means of establishing a legacy.

The Self-Funded Safety Net: Greater Control and Independence

Recent reforms indicate a shift from reliance on state support to an emphasis on personal empowerment in retirement planning. For high-income earners, this entails complementing pensions with self-managed accounts—utilizing the new contribution limits established by reforms to create a financial cushion that aligns with their spending patterns.