For newcomers with significant wealth, stocks, mutual funds, and bonds represent more than mere “levels of risk” – they are specialized instruments designed to enhance (and safeguard) financial resources. Grasping their mechanisms for returns and underlying hazards clarifies matters swiftly.

Stocks: Gains from Expansion, Risks from Instability

The profits from stocks emerge from two main areas: the rise in company earnings (which boosts stock prices) and dividends (periodic distributions). However, there’s a downside—reputable companies can encounter unforeseen challenges, like regulatory changes, technological disruptions, or shifts in market perception that can wipe out profits in an instant. For those with high incomes, this indicates that while stocks can reward thorough analysis, excessive investments in a single area can be detrimental.

Funds: Gains from Variety, Risks from Misalignment

Funds generate profits by aggregating money to invest in a multitude of assets, which mitigates individual asset failures. Nonetheless, not every fund offers the same advantages. A fund that closely shadows an index might levy substantial fees for imitating market results, while a fund focused on a specific sector’s performance ties its returns to the fortunes of that industry. The danger lies in selecting funds that are incongruent with your financial objectives.

Bonds: Returns from Trust through Contracts, Risks from Rate Fluctuations

Bonds provide consistent interest payments since they essentially represent borrowed money to countries or companies. Their value declines when interest rates increase, as new bonds provide better yields, making older ones less appealing. For wealthy investors, long-term bonds carry “interest rate risk,” while corporate bonds introduce the potential for default by the issuer.

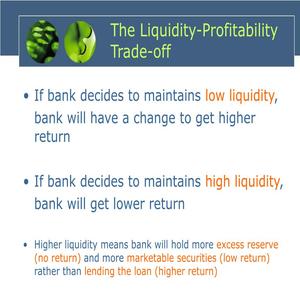

The Need to Recognize the “Liquidity-Return” Tradeoff

Stocks provide the ability to quickly convert assets into cash, yet this flexibility is accompanied by price fluctuations. Bonds, particularly those meant for the long term, can be challenging to sell promptly without incurring a loss. Funds find a middle ground—most can be liquidated within days—but certain specialized funds may impose restrictions on withdrawals.

Obscured Costs That Diminish Returns

Investors in stocks face transaction costs and tax ramifications from short-term profits. Funds impose expense ratios (annual fees) that quietly diminish returns—an annual fee of 1% may seem insignificant, but it can greatly impact long-term profits. Bonds contain “yield to maturity” details that obscure the actual returns after expenses.

The “Stability Illusion” of Safe Investments

Bonds are not invariably “secure.” A government bond during a period of high inflation reduces its purchasing capacity, even if the initial investment is returned. Funds branded as “conservative” may include volatile corporate bonds. True security derives from aligning investments with your time horizon rather than relying solely on their classifications.

In a brief span of three minutes, the conclusion is unmistakable: Returns are determined by the method each asset employs to generate income, and risks revolve around your financial aspirations. For individuals with considerable wealth who are just starting out, the optimal strategy is never to rely on a single asset—it’s the combination that aligns with your time frame and risk tolerance.