The Tangibility Premium

Inflation decreases the worth of cash, but tangible assets with limited supply tend to thrive. For example, consider the ownership of rare earth minerals. These resources are essential for technology and renewable energy, so when the demand surpasses supply, their prices rise. Putting $500,000 into lithium mining rights could lead to an annual return of 8-10%, exceeding the 7% inflation rate. Moreover, fine art contributes beyond beauty: established works by emerging artists have historically appreciated at 12-15% each year and can be easily transported. Such investments not only safeguard wealth but also create it as inflation erodes the value of money.

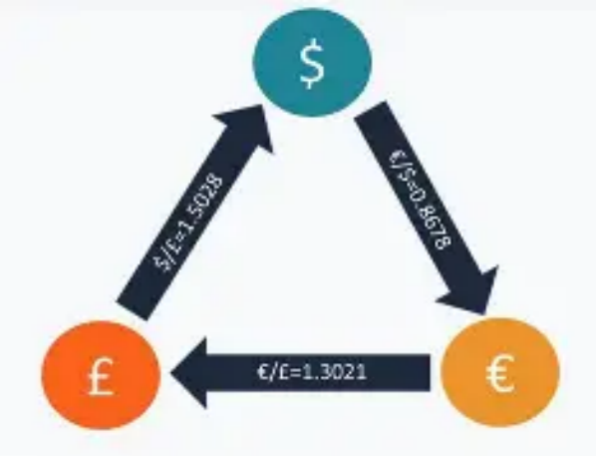

Currency Arbitrage for the Affluent

Depending solely on one currency during inflationary periods can pose risks. To safeguard yourself, think about diversifying your investments into stablecoins linked to lesser-used currencies, such as the Singapore dollar, which experiences a 2% inflation rate, or the Swiss franc, recognized for its reliability. If you have a substantial amount to invest, offshore structured notes tied to a mix of robust emerging market currencies could yield returns of 5-6% beyond inflation. This strategy differs from foreign exchange trading; it aims at building a currency portfolio that protects your assets when your domestic currency declines in value.

Productive Real Estate Beyond Residences

Rental apartments are found in abundance, but industrial spaces frequently go unnoticed. In large urban areas, warehouses for e-commerce, cold storage facilities, and data centers typically have a vacancy rate below 3%, offering annual returns between 8% and 12%. Putting $2 million into a logistics center near a port can generate steady cash flow that rises with inflation, as numerous lease agreements include yearly increases of 3-5%. Such properties fulfill essential needs and their value remains unaffected by fluctuations in the housing market.

Intellectual Property as Inflation-Proof Assets

Earnings can originate from different avenues such as patents, trademarks, or hit podcasts, and these income sources may grow over time. For instance, a pharmaceutical patent that earns $100,000 annually in royalties is likely to yield even higher income as healthcare costs rise. Moreover, investing in music royalties—granting rights to songs by famous artists—has produced yearly returns of 9-11%, while streaming numbers have stayed steady despite economic fluctuations. Even though these assets are intangible, they still create actual cash flow that exceeds inflation rates.

The Subscription Economy Hedge

Investing in shares of companies that operate on subscription models can offer benefits during inflationary periods. Enterprises like software businesses, upscale clubs, and premium content platforms frequently increase their prices but still keep their customers. If an investor allocates $1 million into a private equity fund that targets these types of companies, they can anticipate annual returns ranging from 15-20%, enjoying a steady income that increases alongside inflation. Instead of letting the investment remain unused, it actively participates in systems designed to capitalize on rising prices.

Sectors such as high-end educational technology and specialized health management subscriptions also demonstrate strong performance. Their unique offerings—personalized learning solutions and 24/7 expert assistance—help maintain customer loyalty despite price hikes, generating revenue that surpasses inflation rates. An investment of $500,000 in these niches has yielded an annual growth rate of 18-22%, as users pursue sustainable quality.