It involves much return but will always have an innate risk involved with it. However, the management of a risk requires education on its proper control so that risks get mitigated and investments produce prosperous returns for a long term. This article turns out some key risk management strategies that every investor needs to know about to protect their investment.

Key Takeaways

• Risk management is an investment strategy that safeguards investments against any vagaries of the market and its downward movements.

• Hedging along with asset allocation tends to cap possible losses to a certain extent.

• Your investment strategy is determined by your risk tolerance.

What is Risk Management in Finance?

For this reason, the process of risk management will focus on finding possible losses and analyzing and controlling them within the portfolio. Risk can't be wholly

prevented; very smart strategies merely mitigate adverse occurrences like crashes or recessions.

Why is Risk Management Important?

The most basic thing is risk management because it gives you a chance to cover

your capital as you hunt for entry points that would leverage the growth possibilities. Without the right kind of risk management, even the best investment plan can

collapse due to sudden fluctuations in the market or unexpected economic instability.

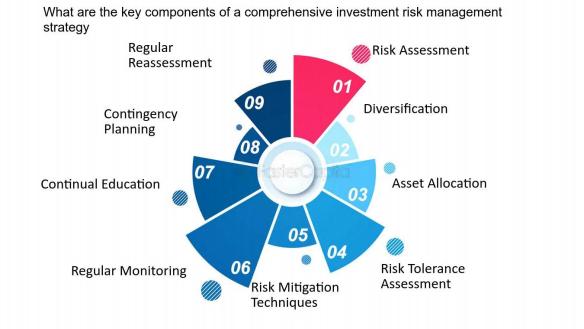

Major Techniques of Risk Management

1. Diversification

It involves making investments in a variety of assets, such as bonds, equities, and real estate. This, therefore, very effectively avoids a relatively poorly performing

investment from 'overflowing' into your overall portfolio. For example, if the equity market is in the doldrums, then your bonds or real estate investments are steady or still growing, hence reducing the loss.

• Increases the chances of income.

• It reduces one's risk of asset class loss.

2. Asset Allocation

Asset allocation is the redistribution of your investment to other asset classes so that you may be able to realize a feasible financial objective or acceptable level of risk

and also suitable horizon. A diversified portfolio typically consists of equities and bonds, as well as other asset classes, which may contribute to growth and stability with regards to income.

Asset Allocation Example

• Allocations as high as 95% of equity can be given to long time horizon young investors.

• Retirees or close-to-retirement should be better suited to allocation to bonds as a source of generating income and lower volatility

3. Hedging Strategies

There are types of hedging that can be done through options or futures to hedge against the unfavorable risks on investments. A simple way that hedging is

expressed is such that when one buys a "put option" on equity, it gives a person the right to sell that equity at some specified price so that one would minimize losing

equity value if it were to fall.

4. Orders to Stop Losing

An automatic trigger that sells a stock when its price drops to a set level is called a stop-loss order.

Therefore, you do not experience extreme losses as you will have sold the underperforming asset before losing more.

Benefits:

• Less emotional decisions while in a melt-down market.

• Before a stock's price falls sharply, lock in profits.

5. Maintaining an Ideal Asset Allocation

At some point, your portfolio assets will either rise or fall and push you out of your target asset allocation. Periodic rebalancing of your portfolio brings your investment back on track to your risk level and financial goals.

How to Rebalance

• Review your portfolio annually

• Buy or sell assets to keep the portfolio in line with its target asset allocation.

• Find ways to minimize both transaction costs and tax liabilities.

6. Recognizing Your Comfort Level with Risk

The amount of return Changes that you can accept depends on your risk tolerance. Reflect on how those types of factors affect your risk tolerance-but in terms of your financial goals, your time horizon for investments, and your ability to personally live with risk.

Steps to Determine Your Risk Tolerance:

• Short-term and long-term goals

• Risk Tolerance Tests/Seeking Advice

• You might take online tests to ascertain the risk levels or seek an advisor.

Conclusion

What Investors Should Learn

Risk reduction can be achieved through diversification, asset allocation, and hedging.

Be informed about your personal risk tolerance so that you can have the right investment strategy for you.

The portfolios should be rebalanced periodically to achieve the realized level of risk and long-term goals.

Successful investing has returns and manages the risk too. You'd be able to provide an adequate cover to your investment against losses and maximize potential long- term growth by the application of these techniques in managing your risks.