A financially literate individual can efficiently and with a basic understanding manage personal finances. The world is moving at such a whirlwind pace that this creates a very vital need for achieving independence from debt and also amassing wealth.

This guide takes you through a step-by-step approach to tell the reader about the

basics of financial literacy that empower you with skills on how to make smart money use.

Essential Information Regarding Financial Literacy:

• Financial literacy is budgeting, saving, investing, and managing debt

• Ethical and moral principles serve as the foundations of understanding.

• Healthy habits begin at a young age, opening the doors to long-term financial security

What is Financial Literacy?

The ability to manage finances rightly, save money, and live on less and little or no debt. In basic terms, it refers to using smart financial judgment to reach one's own financial goals. If you lack financial literacy, you could easily waste money, collect debt, or skip chances to increase your wealth.

Debt Management

There is also knowledge regarding managing debt. Debt sometimes is useful, such as when paying a mortgage on a house, but usually, one finds high-interest debt, which is called credit card debt and should be avoided since it can mushroom if not well managed.

Managing Debt Tips

Pay high-interest balances off as soon as you can and avoid new debt that's possible once you don't need it.

Pay the minimum amount by the date of your respective due date to avoid extra cost of late fees and penalties.

Regarding debt payments, a rule of thumb would be that these should not exceed 30 percent of your monthly income. Such a limit would ensure your stability in finance and you wouldn't be buried under a mountain of debt.

Investment:

Of course, saving is just one of the ways of generating wealth eventually. But compared to saving, investment takes your money to grow through interest or dividends without requiring you to toil for them right away.

Basic investment tools include real estate and mutual funds.

Saving

Saving money is the most significant way to ensure financial security. Ideally, you

must save at least 20 percent of your income for every month; however, this will vary based on status. An emergency fund must be your first priority, followed by long-term goals that include houses, business, or retirement.

Benefits of Saving:

• It also gives them monetary security in such eventualities.

• • It helps in getting medium- and long-term financial goals like retirement and property ownership.

• It helps in the alleviation of financial tensions since it provides a cushion in the case of quick expenditures.

Why You Should Invest

Growth in your wealth will get you much faster with compound interest through savings aided by investment.

Savings for retirement, like putting money into a 401(k) or IRA, help you earn money toward true independence.

Invest diversification: limits your risk while still being protected in volatile markets

Any time you invest, there is always a small chance of losing; however, the more information about that loss you can absorb, the bigger your upside potential.

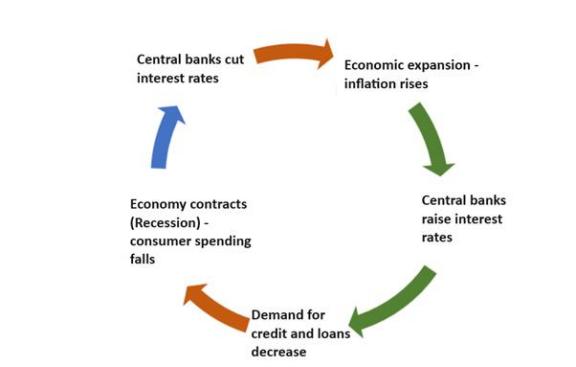

Understanding Interest Rates and Inflation

Of course, to know how to manage the finances one needs to understand interest rates and inflation. The cost of taking out loans is called interest, while prices is the steady increase in prices of goods and services over time. Proper understanding of such factors could inform your borrowing, saving, or even the investment option you may have in your financial situation.

High-interest debt: (e.g., credit cards) to be paid off quickly, so not to cash interest into, which mounts over time.

Inflation: decreases purchasing power as time goes by, so assets that outpace inflation are acquired, such as stocks or real estate.

Your process of building higher levels of personal financial literacy is never-ending. You will be more capable of making the greatest financial decisions as you increase your reading level. Here are some ways to acquire better financial knowledge:

Read books or articles: related to personal finance. There are very many resources out there to help you read much more about budgeting, saving, investing, and debt management.

Online courses: in personal finance. There are plenty of free and low-cost

educational websites and courses that can help get a firm grasp of the basics of finance and a hold on managing one's money. Some of these are MyEnglish.net.

Financial advisor: If a person has no clue where to begin or has definite goals for managing one's finances, then the best advice is to seek the assistance of an expert.

Monitor the expenditure and savings day-to-day. Their control will keep you on the right track while even opening doors for adjustment and adjustment.

Conclusion:

Financial literacy, although one of the most crucial life skills, can guide you toward personal financial independence and then toward debt-free living, and finally lead to wealth generation over time. It can be said to make you take informed decisions that are sure to lead to an assured and prosperous future. If you invest some time in

learning about personal finance, you'll definitely be successful financially.